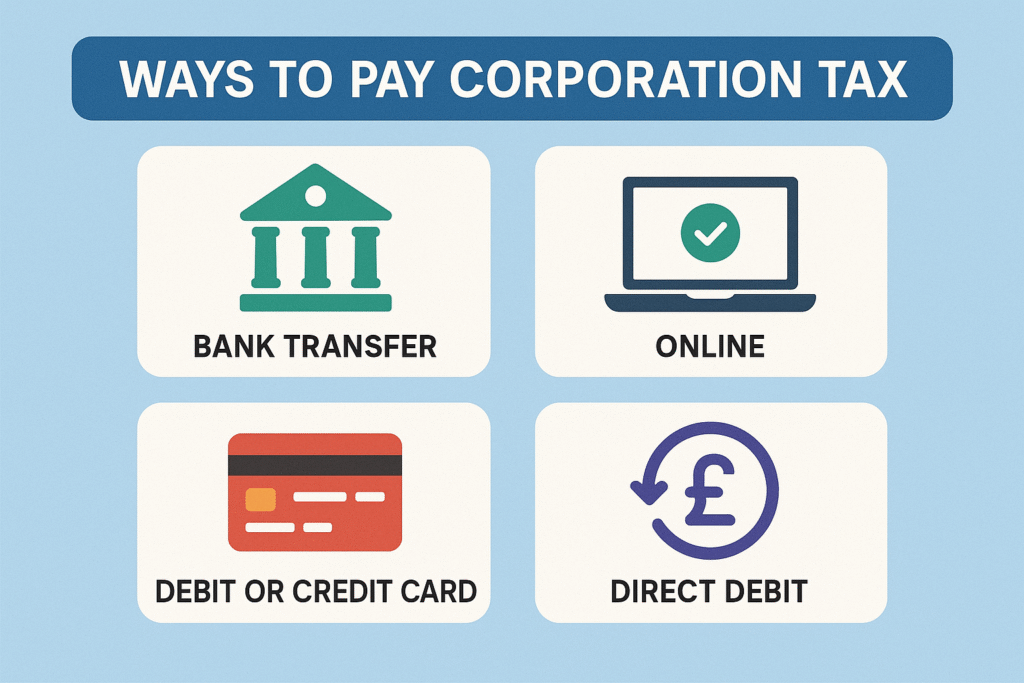

Paying corporation tax is a critical responsibility for any company. Whether you’re a startup or an established business, understanding the different ways to pay corporation tax can save you time, reduce penalties, and help manage your cash flow more effectively. In this guide, we’ll walk you through the most reliable options for corporation tax bill payment, including how to pay online, by installments, and even using a credit card.

1. Understanding Corporation Tax Obligations

Corporation tax is a levy imposed on the profits of companies. In most jurisdictions, it is calculated annually based on your net income after allowable expenses. The deadline and payment process vary depending on where your business is based, but one thing remains constant—timely payment is crucial to avoid penalties and interest charges.

2. How to Pay Corporation Tax Online

One of the most convenient and widely-used methods is paying corporation tax online. This method ensures your payment is processed quickly and securely, often with instant confirmation.

Benefits of paying online:

- Immediate confirmation of payment

- Secure transaction through your national revenue agency’s portal

- Ability to track previous payments and due dates

- To pay online, you’ll typically need:

- Your corporate tax reference number

- Your company’s banking details

- Access to your tax authority’s payment system (such as HMRC in the UK or the IRS in the US)

3. Pay Corporation Tax with a Credit Card

Yes, you can pay corporation tax with a credit card in some regions. However, this option comes with pros and cons.

Pros:

- Convenient if you’re short on cash

- Potential to earn credit card rewards or points

- Immediate processing (usually within 24 hours)

Cons:

- High processing fees (1.5%–3% depending on the card)

- Interest charges if you don’t pay the balance quickly

- Not accepted by all tax authorities

Before choosing this method, check if your tax authority supports credit card payments and review any associated fees.

4. Pay Corporation Tax by Instalments

For businesses that find it challenging to pay their tax bill in one lump sum, many countries allow you to pay corporation tax by instalments. This is especially helpful for seasonal businesses or those with fluctuating income.

In some jurisdictions, this is called a Time to Pay arrangement or a Corporate Instalment Plan. These plans typically allow you to:

- Spread payments over several months

- Avoid large cash flow hits

- Stay compliant as long as payments are made on time

Eligibility often depends on:

- The size of your tax bill

- Your company’s payment history

- Financial hardship or inability to pay in full

5. Corporate Quarterly Tax Payments

In many countries, corporations are required to make quarterly estimated tax payments based on projected income. This system helps businesses stay current with their tax obligations and avoid underpayment penalties.

Quarterly payments usually occur in:

- April

- June

- September

- December

To calculate your quarterly taxes, estimate your annual income and divide the expected tax evenly across the year. Tools and calculators are often available through your tax authority to help with this process.

6. Tips for Managing Your Corporate Income Tax Payment

Handling your corporate income tax payment doesn’t have to be stressful. Here are a few tips to simplify the process:

- Automate payments to avoid missing deadlines

- Hire an accountant or tax advisor to ensure compliance

- Use accounting software that integrates with your tax portal

- Keep detailed records for audits and deductions

Paying on time not only saves your business from interest and penalties but also enhances your financial credibility.